New classical macroeconomics is a school of macroeconomic thought built on a neoclassical framework. There is a strong emphasis on the importance of rigorous foundations based on microeconomics, especially rational expectations.

New classical macroeconomists aim to provide neoclassical microeconomic foundations for macroeconomic analysis, unlike the rivaling new Keynesian economists who use microfoundations such as price stickiness and imperfect competition to generate macroeconomic models similar to the old Keynesian ones.

Assumptions

- New classical macroeconomics is built on Walrasian assumptions.

- All agents are assumed to maximize utility based on rational expectations.

- The market is assumed to clear at all times, through price and wage adjustments.

Models

- New classical macroeconomists have pioneered the use of representative agent models.

- One of the most well-known of the new classical models is the real business cycle model developed by Edwards C. Prescott and Finn E. Kydland.

The three diagnostic sources

The new classical perspective on macroeconomics takes root in three diagnostic sources of fluctuations in growth:

- The productivity wedgeA simple measure of aggregate production efficiency. When there is a productivity wedge, the economy is less productive given the capital and labour resources available in the economy.

- The capital wedgeWhen there is a capital wedge, there is a gap between the intertemporal marginal rate of substitution in consumption and the marginal product of capital.

- The labour wedgeA labour wedge is a ratio between the marginal rate of substitution of consumption for leisure and the marginal product of labour.

New classical macroeconomists use diagnostics, alongside business cycle accounting, to find the main reasons behind fluctuations in the real economy.

The development of the new classical school of thought in macroeconomics

The new classical macroeconomics evolved from monetarism, and the early new classical economists labelled themselves monetarists. Eventually, the school broke with a key monetarist belief; the idea that monetary policy could systematically impact the economy. The school instead embraced a real business cycle model that ignored monetary factors.

While the monetarists had built on Keynesian ideas, the new classical macroeconomists broke with Keynes and delivered sharp criticisms of his models. Soon, the monetarists were no longer the main opponents of Keynesianism – the new classicalists were. Yet, they did largely remain true to the Keynesian focus on trying to explain short-run fluctuations in the economy, and it took quite some time before the primary debate in macroeconomics shifted from “should we look at short-run fluctuations” to “should macroeconomic models be grounded in microeconomic theories”.

Influential new classical economists alleged that earlier macroeconomic theory was based only tenuously on microeconomic theory. They also argued that governments did not have much ability to stabilize an economy since it was driven by the rational expectations of the economic agents. The new classical macroeconomists blew new life into the market clearing assumption and argued that the market should be modelled at equilibrium.

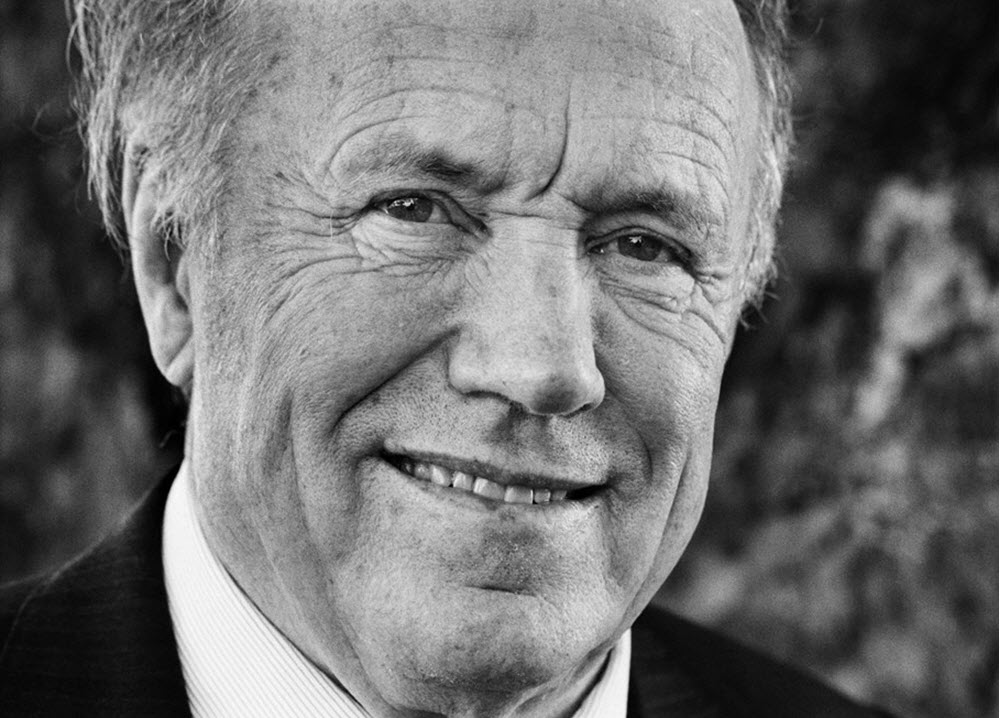

Notable scholars

Some of the strongest voices of the emerging school of new classical macroeconomics were Robert Lucas at the University of Chicago, Edward Prescott at the University of Minnesota and Robert Barro at the University of Rochester.