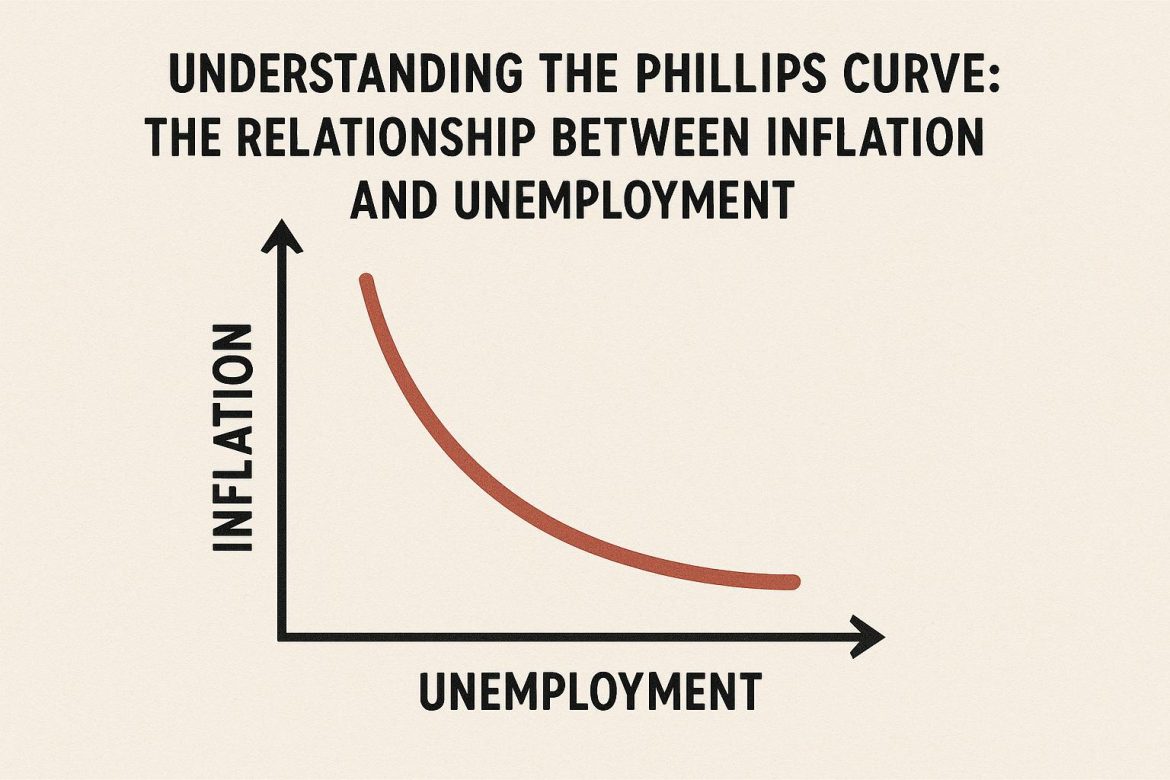

Introduction to the Phillips Curve

The Phillips Curve is a foundational concept in macroeconomics, illustrating the dynamic interplay between inflation and unemployment. An inverse relationship characterizes this theory, suggesting that as inflation rates climb, unemployment rates typically decline, and vice versa. Emerging in the late 1950s, this concept provides critical insights into economic policymaking, specifically how to balance inflation control and unemployment reduction.

Historical Background

The origins of the Phillips Curve trace back to the pioneering work of economist A.W. Phillips. He meticulously analyzed historical data from the United Kingdom, ranging from 1861 to 1957, to explore the relationship between wage inflation and unemployment rates. Phillips observed a pattern indicating that periods of low unemployment were consistently accompanied by higher wage inflation. This led to the proposition of a potential trade-off between these two essential economic indicators. Initially focused on wage inflation, the concept was gradually expanded to encompass the broader scope of price inflation.

Phillips’s work set the stage for deeper explorations into the mechanics of the economy, as his observations were adapted to a broader interpretation that includes price inflation, which is more directly relevant to overall economic health and policy.

Theoretical Foundation

At the core of the Phillips Curve is the principle that labor markets function efficiently, a notion that suggests a correlation between labor demand and wage levels. When labor demand is high, wages increase as employers compete to attract and retain employees. This increase in wages boosts consumer spending, thereby fueling inflation. On the flip side, higher wages can encourage more individuals to enter the labor force, reducing unemployment levels as more jobs are made available at attractive wage rates. This relationship offers a framework for policymakers as they evaluate potential trade-offs when formulating economic policies.

Understanding this dynamic enables economists to decipher how adjustments in one area, such as interest rates or government spending, might impact both inflation and unemployment, facilitating more informed decision-making.

Short-Run vs. Long-Run Phillips Curve

Economists differentiate between the short-run and long-run perspectives regarding the Phillips Curve. In the short run, the inverse relationship is particularly pronounced due to price and wage rigidity. These rigidities can prevent markets from immediately reaching equilibrium in response to changes in economic conditions. For instance, businesses may be hesitant to quickly adjust wages or prices in response to shifting demand, creating temporary mismatches in expectations and actual economic outcomes.

Over the long run, however, the curve takes on a vertical shape at what is referred to as the natural rate of unemployment. Here, the belief is that inflation exerts no lasting influence on unemployment because workers and employers eventually adjust their expectations. As these expectations align, wages correspond more closely with their real purchasing power, negating the short-term disparity seen in the Phillips Curve.

Changes Over Time and Criticisms

Throughout its existence, the Phillips Curve has been subject to various criticisms and adaptations. The theory faced significant scrutiny during the 1970s amidst the economic phenomenon known as stagflation, characterized by the simultaneous occurrence of high inflation and high unemployment. This period defied the traditional view of the Phillips Curve, challenging the notion of an inverse relationship between these two factors.

In response, noted economists, including Milton Friedman and Edmund Phelps, proposed modifications to the Phillips Curve that emphasize the role of expectations, particularly inflation expectations. This led to the development of the expectations-augmented Phillips Curve. By recognizing that individuals and businesses formulate expectations about future inflation, this adaptation incorporates those expectations into the model. As economic agents adjust their behavior in anticipation of inflation, the predicted inverse relationship between inflation and unemployment may not hold, as both could simultaneously rise or fall.

Expectations-Augmented Phillips Curve

The expectations-augmented version of the Phillips Curve underscores the pivotal role inflation expectations play in shaping economic outcomes. If these expectations accurately anticipate future inflation, they can alter behaviors, such as wage bargaining and price setting, potentially diminishing the clear inverse relationship originally proposed. This shift accounts for the adaptive nature of economies, where expected changes in policy or economic conditions influence actual behaviors, leading to outcomes that deviate from traditional models.

In practical terms, this adaptation highlights the necessity for policymakers to consider how their actions might shape economic expectations, as these expectations can significantly influence the effectiveness of monetary and fiscal policies.

Policy Implications

The insights offered by the Phillips Curve have profound implications for the formulation of monetary and fiscal policies. Policymakers leverage the relationship between inflation and unemployment to design strategies aimed at maintaining economic stability. Tools such as interest rate adjustments and government spending are employed to influence these conditions, managing the delicate balance between mitigating inflation and reducing unemployment.

However, the ever-evolving nature of economic dynamics means that reliance on the Phillips Curve must be tempered by a consideration of contemporary data and indicators. Shifting consumer behavior, technological advancements, and global economic trends can all sway the applicability and accuracy of the Phillips Curve, necessitating an adaptable and nuanced approach to economic policy decisions.

Conclusion

In essence, the Phillips Curve endures as a fundamental concept within economic theory, offering essential insights into the intricate relationship between inflation and unemployment. Despite its limitations and the critiques it has faced, the theory remains a vital tool for understanding the trade-offs inherent in economic policymaking. As the economy continues to evolve, so too will the interpretations and applications of the Phillips Curve, ensuring its continued relevance in guiding policy decisions. Readers seeking an in-depth exploration of the Phillips Curve can access detailed discussions in economic research platforms and resources such as the National Bureau of Economic Research or the International Monetary Fund.

This article was last updated on: October 9, 2025